Forrestania Gold Project

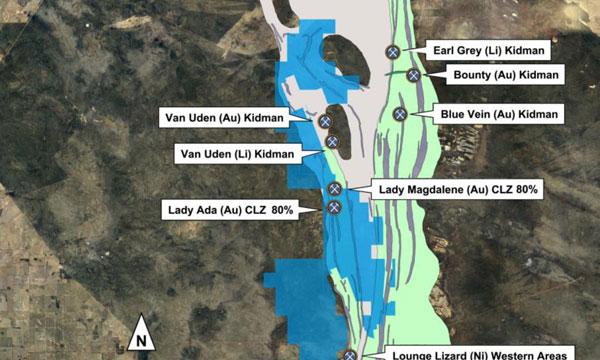

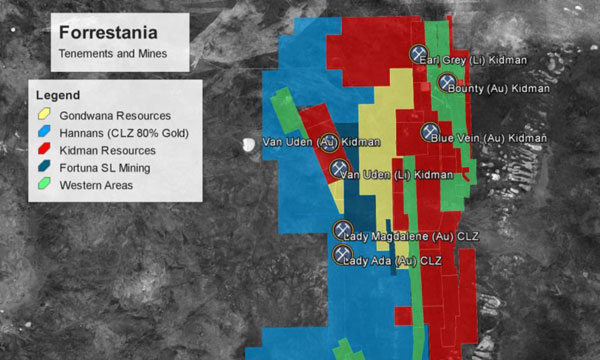

Classic’s Forrestania Gold Project is located approximately 120 km south of Southern Cross, Western Australia and contains the Lady Ada and Lady Magdalene deposits.

Classic (CLZ) has acquired 80% of the gold rights on the FGP Tenements whilst Hannans (HNR) has maintained its 20% interest in the gold rights.

Classic Minerals has inferred and indicated Mineral Resources of 7.27Mt at 1.33g/t for 311,050 ounces of gold ounces at FGP, classified and reported in accordance with the JORC Code (2012), with a recent Scoping Study suggesting both the technical and financial viability of the project.

Highlights

- The FGP is host to two JORC compliant Mineral Resource Estimates (MRE); Lady Ada and Lady Magdalene. The most recent MRE for these two deposits were completed in December 2019 and January 2020 by Cadre on behalf of Classic Minerals. The following sub-sections are summarised from Broomfield 2019 and 2020.

- Binding agreement signed for 80% of the Gold Rights at Forrestania Gold Project.

- Existing and growing ~311K ounce JORC Resource with strong exploration upside.

- Scope for high grade open pit mining – previous mining produced 95,865 tonnes @ 8.81g/t for 27,146 oz Au.

- 500km² tenement package covers over 50km strike length of the Forrestania greenstone belt.

- High gravity gold recovery with free-milling gold – non-refractory ore.

- Existing resources are amenable to conventional open pit mining.

- Low capital costs via processing through local toll treatment facilities – advanced discussions underway.

- Located in one of Australia’s most prominent regions for gold mining.

- Value accretive asset with early production opportunity.

Resources

The Forrestania Gold Project contains an existing Mineral Resource of 7.27Mt at 1.33g/t for 311,050 ounces of gold, classified and reported in accordance with the JORC Code (2012), with a recent Scoping Study (see ASX Announcement released 2nd May 2017) suggesting both the technical and financial viability of the project. The current post-mining Mineral Resource for Lady Ada and Lady Magdalene is tabulated below. Additional technical detail on the Mineral Resource estimation is provided, further in the text below and in the JORC Table 1 as attached to ASX announcements dated 14th March 2017 and 21st March 2017.

| Prospect | Classification | Tonnes | Grade (Au g/t) | Ounces Au |

|---|---|---|---|---|

| Lady Ada | Indicated | 257,300 | 2.01 | 16,600 |

| Inferred | 1,090,800 | 1.23 | 43,100 | |

| Total | 1,348,100 | 1.38 | 59,700 | |

| Lady Magdalene | Inferred | 5,922,700 | 1.32 | 251,350 |

| Total | 5,922,700 | 1.32 | 251,350 | |

| Total | 7,270,800 | 1.33 | 311,050 | |

Notes:

- The Mineral Resource is classified in accordance with JORC, 2012 edition.

- The effective date of the mineral resource estimate is 31 December 2016.

- The mineral resource is contained within FGP tenements.

- Estimates are rounded to reflect the level of confidence in these resources at the present time.

- The mineral resource is reported at 0.5 g/t Au cut-off grade.

- Depletion of the resource from historic open pit mining has been taken into account.

Lady Ada

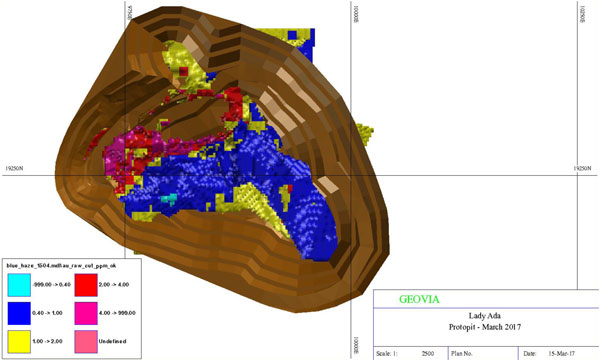

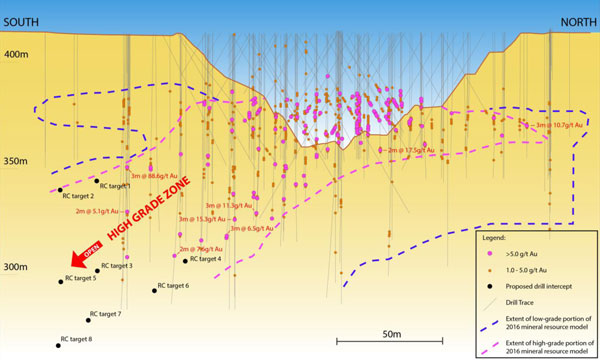

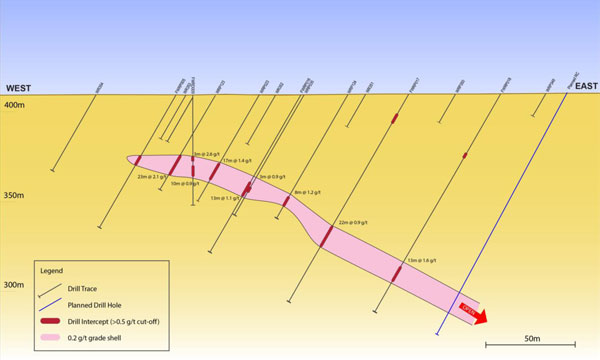

Upon first examination of the dominantly west-dipping orientated drill lines, the mineralisation appears to be diminishing at depth. However, when the high-grade intervals (>5.0 g/t Au) are displayed in plan-view (see appendix 2 of ASX Announcement dated 14 March 2017) a south-easterly plunging trend is readily observable. When cross-sections are created parallel to the high-grade plunge, it is clear the mineralisation is open at depth as shown in the oblique and cross sections provided in Figures 2 & 3.

The mineralisation at Lady Ada is hosted within the Sapphire Shear, which presents as two zones of stacked shallow dipping faults. The grades within the shear are variable (typical of shear hosted systems) and present commonly as intervals of 2-3 m, with average grades frequently ranging up to 5.0-15.0 g/t Au. Figure 1 and Figure 2 show high-grade intercepts that have not been closed off at depth. The main (eastern) high-grade part of the Mineral Resource is 55 m wide with a down-dip length of 230 m; the second (western) high-grade part of the Mineral Resource is approximately 35 m wide with a down-dip length of 170 m (as first reported in the ASX announcement from 9 March 2017).

MARC001 was a standout hole which yielded very impressive, high grade gold mineralisation at a shallow depth (38m) in an area that is outside of the current optimised pit design.

The strong results point to both an increase and an upgrade in Resources at the Forrestania Gold Project. The drilling was designed to target mineralisation outside of the current resource model as well as high-grade extensions below and adjacent to the current pit design, in line with Classic’s strategy to sufficiently grow its Mineral Resources to a size that supports establishment of an on-site processing facility at FGP as contemplated in FGP scoping study (see ASX announcement released 2nd May 2017). Best results include:

- 34m @ 2.14 from 38m – including 6m @ 9.06 g/t Au and 2m @ 15.74 g/t Au from 38 m

- 12m @ 1.74 g/t Au from 64m – including 3m @ 2.03 g/t Au from 72m

- 2m @ 9.77 g/t Au from 109m

- 9m @ 1.30 g/t Au from 66m – including 2m @ 3.58 g/t Au from 73m

- 9m @ 6.23 g/t Au from 36m – including 6m @ 9.06 g/t Au and 2m @ 15.74 g/t Au from 37m

- 11m @ 1.25 g/t Au from 64m – including 2m @ 3.58 g/t Au from 73m

- 1m @ 3.82 g/t Au from 47m

- 2m @ 3.05 g/t Au from 55m

- 5m @ 1.24 g/t Au from 55m

- 2m @ 3.53 g/t Au from 48m

- 2m @ 1.45 g/t Au from 54m – including 1m @ 2.59 g/t Au from 55m

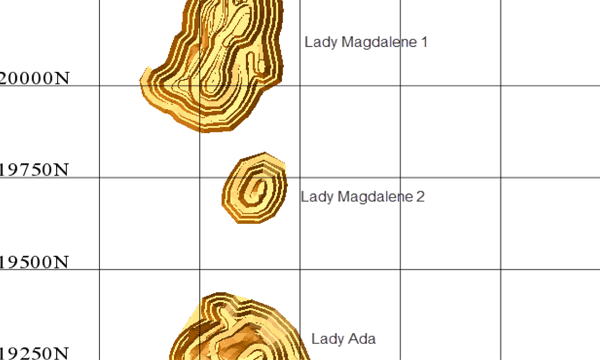

Lady Magdalene

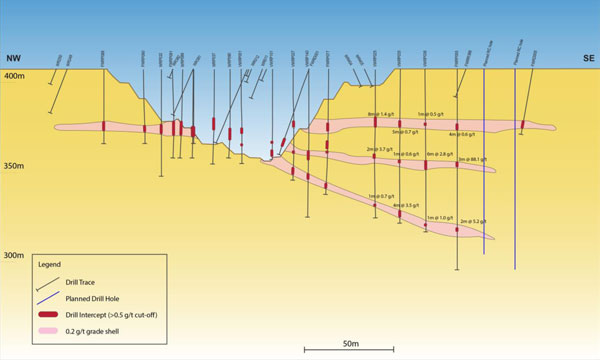

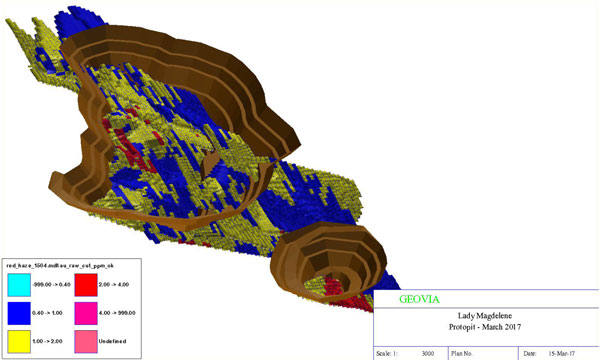

Gold mineralisation at Lady Magdalene (formerly Red Haze) is hosted within a sheared mafic suite. The mineralisation is over a kilometre long, is generally drilled to a down-dip length of 200-300 m (150 m vertical depth), and is generally 10 m thick (true thickness) with a grade range between 1.0 and 5.0 g/t Au. The area was the subject of RC/Diamond drilling, heap- and dump-leaching metallurgical column test work completed by Forrestania Gold NL (LionOre subsidiary) in mid- to late 1999. The gold mineralisation strikes over 500 m north-south and is hosted within the Wattle Rocks Dolerite unit (like Lady Ada), but differs in having multiple, wide (up to 20 m true width), subparallel low-grade shear zones instead of one major, narrow, high-grade shear (the Sapphire Shear) like Lady Ada.

The total Mineral Resource estimated for Lady Magdalene in August 2000 was 2.45 Mt @ 1.65 g/t Au at a 1.0 g/t Au block cut-off grade. The Resource is based on only 50 m x 25 m drill coverage (at best) and higher-grade (supergene) portions of the orebody may become apparent with closer-spaced drilling programmes. Diamond hole FWRD011 had an intersection of 7.0 m @ 9.07 g/t Au (true width unknown), containing visible Au only 25 m from surface and alludes to other, as yet undefined, high-grade intersections being present in the orebody.

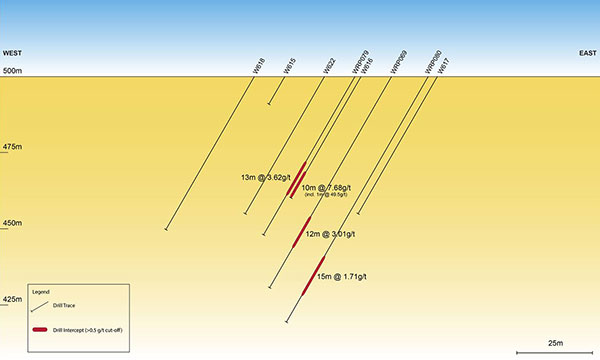

Classic has undertaken drilling at Lady Magdalene throughout 2017 with excellent results. Drilling at Lady Magdalene was designed to target mineralisation outside of the current resource model as well as high-grade extensions below and adjacent to the current pit design. Importantly, results from initial holes have identified an additional zone of high grade mineralisation outside of the current resource which extends at depth and along strike, reaffirming management’s view that the FGP has the potential to host a much larger gold system that can be unlocked through further targeted drilling. Best results include:

- 7m @ 4.95 g/t Au from 138m – including 3m @ 10.0 g/t Au from 141m

- 12m @ 2.08 g/t Au from 139m – including 3m @ 4.6 g/t Au from 142 m

- 4m @ 4.66 g/t Au from 76m

- 17m @ 3.86 g/t Au from 179m – including 9m @ 5.4 g/t Au from 187m

- 2m @ 12.46 g/t Au from 87m – including 1m @ 24.3 g/t Au from 87m

- 2m @ 8.59 g/t Au from 48m – including 1m @ 16.5 g/t Au from 48m

- 6m @ 3.27 g/t au from 74m – including 4m @ 4.6 g/t Au from 76m

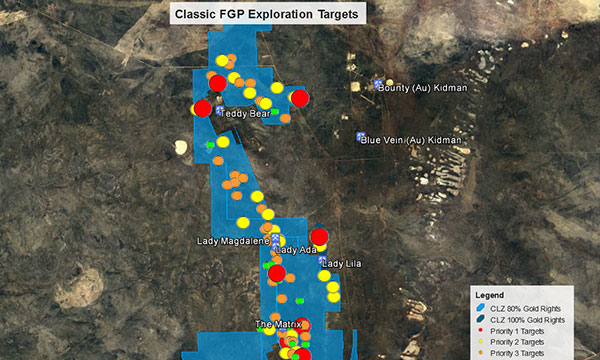

Exploration Targets

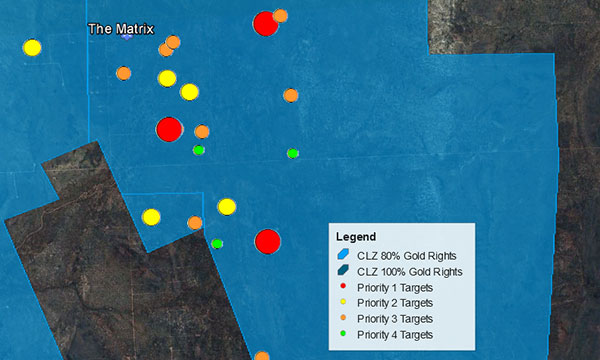

Classic’s new CEO, Mr Dean Goodwin, completed a detailed geological mapping and targeting exercise over the entire Forrestania greenstone belt in the early/mid 2000s. At the time, the primary purpose of the work was to identify additional sources of high grade gold to feed the Bounty processing plant. The targeting study resulted in a ranking system and the identification of more than 300 exploration targets. A number of the targets Dean identified close to Bounty were tested and eventually mined due to the proximity to the processing plant. However, apart from Lady Ada, all of the “Western Belt’s” targets (of which CLZ holds 80% of the gold rights) have remained untouched and undrilled since the study was completed due to changes in ownership and the resulting loss of data/technical reports that come with asset sale transactions and tenement surrenders. This will be the first time in more than 17 years in which the original mapping and targeting study has been re-visited.

I’m really excited to be involved again in this highly prospective area. 17 years ago I mapped the Forrestania belt from the Bounty goldmine in the north all the way down to Hatters Hill in the south, around 120km of strike. It took 2.5 years to put the geological and structural story together. During that time, with the help of Southern Geoscience Consultants, we came up with 322 regional gold targets of which Classic has 98 within its tenement holding. None of Classic’s targets have ever been drill tested. For me, its unfinished business. I can’t wait to get stuck into it.

Dean Goodwin, CEO

The Company is planning an aggressive work program with the aim of developing existing gold resources and discovering new high grade gold deposits within its extensive ground holding at the Forrestania Gold Project. Work will include the completion of resource development drilling and resource calculations at Lady Ada and Lady Magdalene, orientated diamond drilling at Lady Magdalene to identify very high grade gold lodes similar to Lady Ada and extensive regional exploration drilling testing high priority exploration targets for new gold deposits.

Initial work will focus on the completion of phase 2 resource drilling at Lady Ada and Lady Magdalene. This will facilitate the calculation of a new resource base for the Forrestania Gold Project to 2012 JORC standard.

The region is highly prospective for primary gold mineralisation having yielded more than 1 million ounces of gold extracted to date. Remaining known in-ground resources in the region exceed 2.5 million ounces of gold. Exploration work will focus on testing high priority targets specifically those over favourable host rocks including gabbro, which host the Lady Ada and Lady Magdalene deposits, and banded iron formation, which host the 1 million ounce Bounty Gold Mine. The highest ranked exploration targets within the project area have little or no previous drill coverage.

Following the discovery of the aforementioned deposits at FGP, Dean undertook a detailed geological review and mapping exercise of the project and its surrounds, resulting in the generation of many highly ranked exploration targets in the area.

Orientated diamond drilling will be undertaken within the existing Lady Magdalene resource in an attempt to locate high grade cross-cutting gold lodes similar to the Lady Ada deposit which yielded 95,865 tonnes @ 8.81g/t for 27,146 oz Au. Currently existing drilling at Lady Magdalene is too broad spaced to identify these potential high-grade cross-cutting lodes.

In parallel to our regional exploration program we will be looking for high-grade cross-cutting lodes within the Lady Magdalene resource envelope similar to Lady Ada. We found Lady Ada 17 years ago by looking closely at the drilling sections, you could see this high-grade gold lode cutting through from section to section on an angle. It wasn’t running parallel to the main lower grade material. Once we changed the drill orientation, the high-grade zone was instantly apparent and the rest was history. There is very strong evidence to suggest that similar things are happening at Lady Magdalene. There could be multiple Lady Adas hiding within the existing data. Before we looked closely at Lady Ada, both Lady Ada and Lady Magdalene were deemed large low-grade gold resources. It was only after we looked closely at Lady Ada that we saw the high-grade cross cutting lode – I hope to repeat this methodology and discovery at Lady Magdalene.

Dean Goodwin, CEO

The Matrix is our highest priority regional target located 9km south along strike from Lady Ada. Its geological and structural framework is almost identical to Lady Ada and Lady Magdalene with a series of highly prospective cross cutting structures.

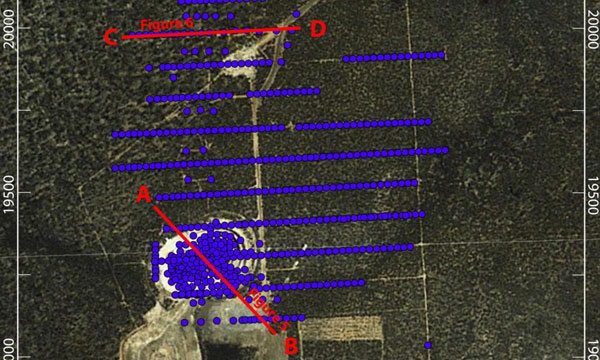

No historical drilling has occurred at the Matrix. The geochemistry is weaker than Lady Ada and Lady Magdalene and it is the Company’s belief that this is function of the transported cover/overburden being slightly thicker than what is seen over Lady Ada and Lady Magdalene. It wasn’t until a magnetic survey was flown in the early 2000s that it became clear that the prospect has a very similar magnetic signature to Lady Ada and Lady Magdalene (significant north/north eastern cross cutting features).

Classic intends to conduct a first phase Air Core/RAB drill program over discreet magnetic features (focusing on cross cutting dykes/structures) at the Matrix as soon as the drill POW has been approved.

Classic considers the Matrix as having the potential to host gold mineralisation due to its similar structural positions to the small, high-grade (~9g/t Au) Lady Ada deposit (8km to the north), the large low-grade (1.5Mt @ ~3g/t Au) North Ironcap Resource (4km to the south) and the large high-grade (~4.5g/t Au) Lounge Lizard deposit (12km to the south). A 1000m x 150m >20ppb Au auger soil anomaly overlies the dolerite but stops under cover to the north and west.

Lady Lila is situated 4km east of Lady Ada and is hosted by a chert/banded iron formation within the younger metasedimentary central zone. The previous drilling is shallow (approx. 50m depth testing) and generally intercepts the mineralised zone only two-three times per section. Additional drilling is strongly recommended and is required to test the orientation, and down dip extension of the mineralisation. The mineralisation at its strongest is 10m wide, over 400m long, and grades between 2.0-5.0g/t Au. A cross section of Lady Lila is displayed in Figure 3. The present gold mineralisation models indicate a steep easterly dip; the any future drilling should plan to test a possible vertical dip, as gold deposits in the area have been known to steepen at depth (e.g., Bounty and Blue Vein held by Kidman Resources). The current drilling commonly fails to drill deep enough to adequately test the steep easterly dip (some holes even terminate in mineralisation), and are insufficient to judge Lady Lila’s prospectivity due to three factors:

- there is well-document transported cover which masks the top 10-20m of deposits in the area (e.g., Lady Ada), potentially obscuring the along strike continuations;

- a zone of gold depletion which may occur under-representing a good deposit (e.g., Bounty Gold Mine);

- the natural variability of gold distributions in BIF hosted systems from zones of high grade to zones of low grade (depending on proximity to Au fluid fault pathway) may provide discouraging results in some RLs and exceptions results in others (e.g., Bounty, Blue vein).

Lady Lila contains a significant strike extent, high and low-grade intercepts, is weakly drilled and requires additional exploration.

Scoping Study

In March 2017, Classic completed a Scoping Study based on the Inferred and Indicated Mineral Resource at the Forrestania Gold Project. The Scoping Study referred to the Lady Ada (formerly referred to as Blue Haze) and Lady Magadalene (formerly Red Haze) deposits.

Highlights

The Scoping Study showed a technically and financially viable project, and based on A$1,700 gold price and 8% discount rate:

- Low initial Capex of between $A25M and A$35M (as a part of the total funding requirement of $A40M-A$45M including an additional contingency of A$2M-A$4M and A$8M-A$10M (working capital).

- 1.9Mt at 1.95g/t Au (diluted) for 111koz produce over a Life of Mine of 2.5 years.

- AISC of A$1,080/oz-A$1,160/oz.

- A$60-A$70 million in free cash flow.

- NPV of A$54-A$58 million.

- Payback/cashflow between months of 18 and 24.